European natural gas gained as colder weather at the end of winter combined with a dip in flows from Norway.

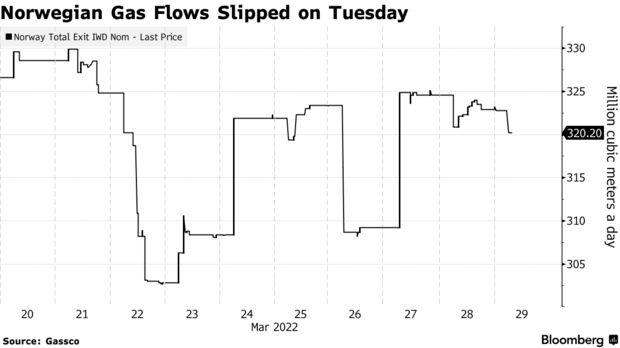

Benchmark futures rose for a second day, reaching the highest levels since Thursday. Norwegian flows slipped amid unplanned outages at the Skarv field. Below-average temperatures are forecast in northwest Europe until about the middle of April.

Still, the end of the heating season is alleviating supply concerns. Despite starting the winter with record-low inventories, “Europe could have more than enough gas to completely fill its storage by October 1,” to beat the European Union’s 90% target, BloombergNEF said.

The best-case scenario of a 100% storage-fill by next winter envisages no disruptions to Russian pipeline flows and European gas prices remaining higher than in Asia to attract spot liquefied natural gas.

For now, with the war in Ukraine in its second month, gas to Europe has been flowing without interruptions. Russian supplies to the continent via key pipeline routes were stable on Tuesday, grid data showed.

However, the unwillingness of European gas buyers to accept President Vladimir Putin’s demand for payment in rubles puts supplies at risk.

“Russian gas flows remain steady, but the prospect of suppliers refusing to pay in rubles could spur further upside,” Alfa Energy said in an emailed note.

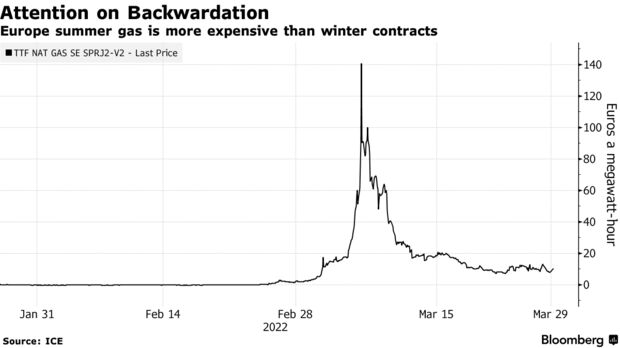

Prompt prices around 100 euros per megawatt-hour just before the summer-injection season are “sending bullish price signals for the upcoming winter,” it said.

The summer contract has been more expensive than winter prices since late February. The market condition known as backwardation — when near-term prices are higher than those at a later date — can indicate tightness.

Dutch front-month gas futures rose 10% to 113 euros a megawatt-hour by 10:42 a.m. in Amsterdam. The April contract expires on Wednesday. U.K. gas advanced 11%.