The Snam Board of Directors, which met yesterday under the chairmanship of Carlo Malacarne, has approved the consolidated half-year Report at 30 June 2018 (subjected to limited audit).

Financial highlights

Financial highlights

- Total revenue: €1,242 million 1 (+€28 million; +2.3% compared with the first half of 2017, thanks to the continuation of the investment plan)

- EBIT: €729 million (+€15 million; +2.1% compared with the first half of 2017)

- Net profit: €523 million (+€19 million; +3.8% compared with the first half of 2017)

- Technical investments: €349 million (€425 million in the first half of 2017)

- Free cash flow: €1,037 million

- Net financial debt: €11,421 million (€11,550 million at the end of 2017)

Operating highlights

- Demand for natural gas: 38.78 billion cubic metres (-1.6% compared with the first half of 2017, due to lower consumption recorded in the thermoelectric sector following the return to normal electricity importing flows)

- Gas injected into the transportation network: 37.93 billion cubic metres (-0.4% compared with the first half of 2017)

- Available storage capacity: 12.4 billion cubic metres (+0.2 billion cubic metres compared with 30 June 2017), of which 11.6 billion cubic metres assigned at 30 June 2018 (equal to 94.1% of the available capacity for the 2018-2019 thermal year)

- Accidents: sharp reduction in accidents compared with the first half of 2017 (3 accidents involving employees and contract workers in the first half of 2018 compared with 7 accidents in the first half of 2017), as a result of Snam’s ongoing commitment to developing and promoting the protection of health and safety in the workplace

Revised guidance:

- 2018 Net Profit: around €1 billion (previous guidance of €975 million)

- Net financial debt at the end of 2018: confirmed at €11.5 billion, including equity investment acquisitions of around €160 million and the share buyback already executed

- 2018 Cost of debt: now expected at 1.6% (previous guidance of 1.8%)

- Efficiency program: targeting savings by 2021 increased from over €40 million to over €50 million

Significant events

- On 30 May 2018, a controlling stake equal to 82% of the share capital of TEP Energy Solution (TEP), one of the main Italian companies active in the energy efficiency sector, was acquired after obtaining antitrust clearance at a total value of approx. €21 million;

- In the first half of 2018, 48,339,437 Snam shares (equal to 1.39% of the share capital taking into account the cancellation of 31,599,715 treasury shares with no share capital reduction were acquired for a total cost of €183 million;

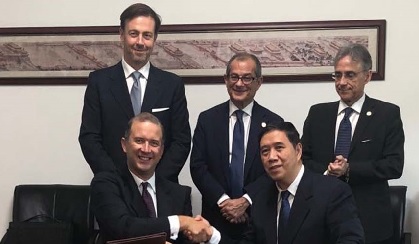

- On 20 July 2018, a European consortium consisting of Snam (60%), Enagás (20%) and Fluxys (20%) entered into an agreement with the Greek agency for privatisations HRADF and Hellenic Petroleum, for the acquisition of a 66% stake in DESFA, the national operator of natural gas infrastructure in Greece.